How to optimize your expense management

Insights from Coupa and Acquis Consulting Group on T&E Spending

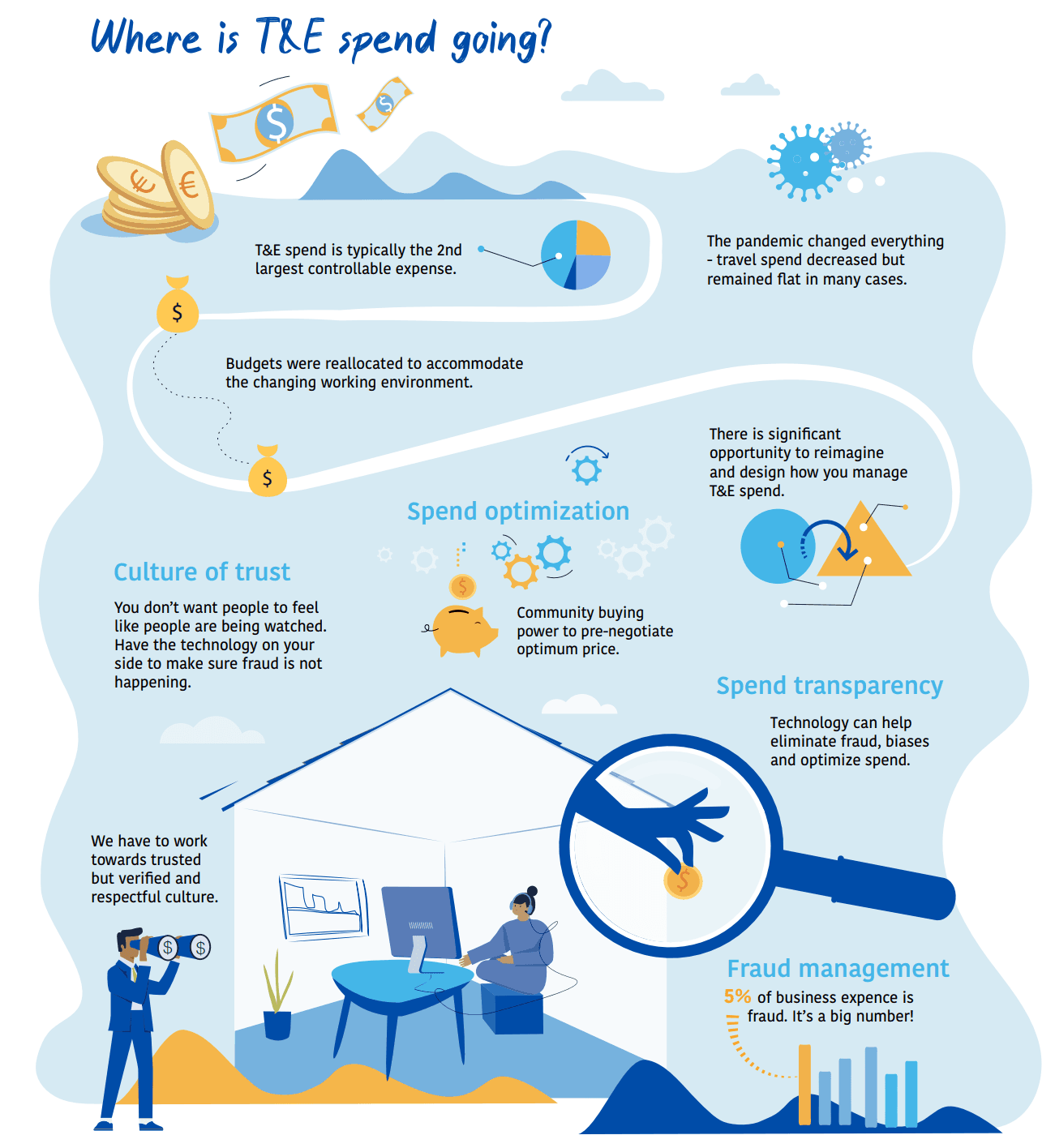

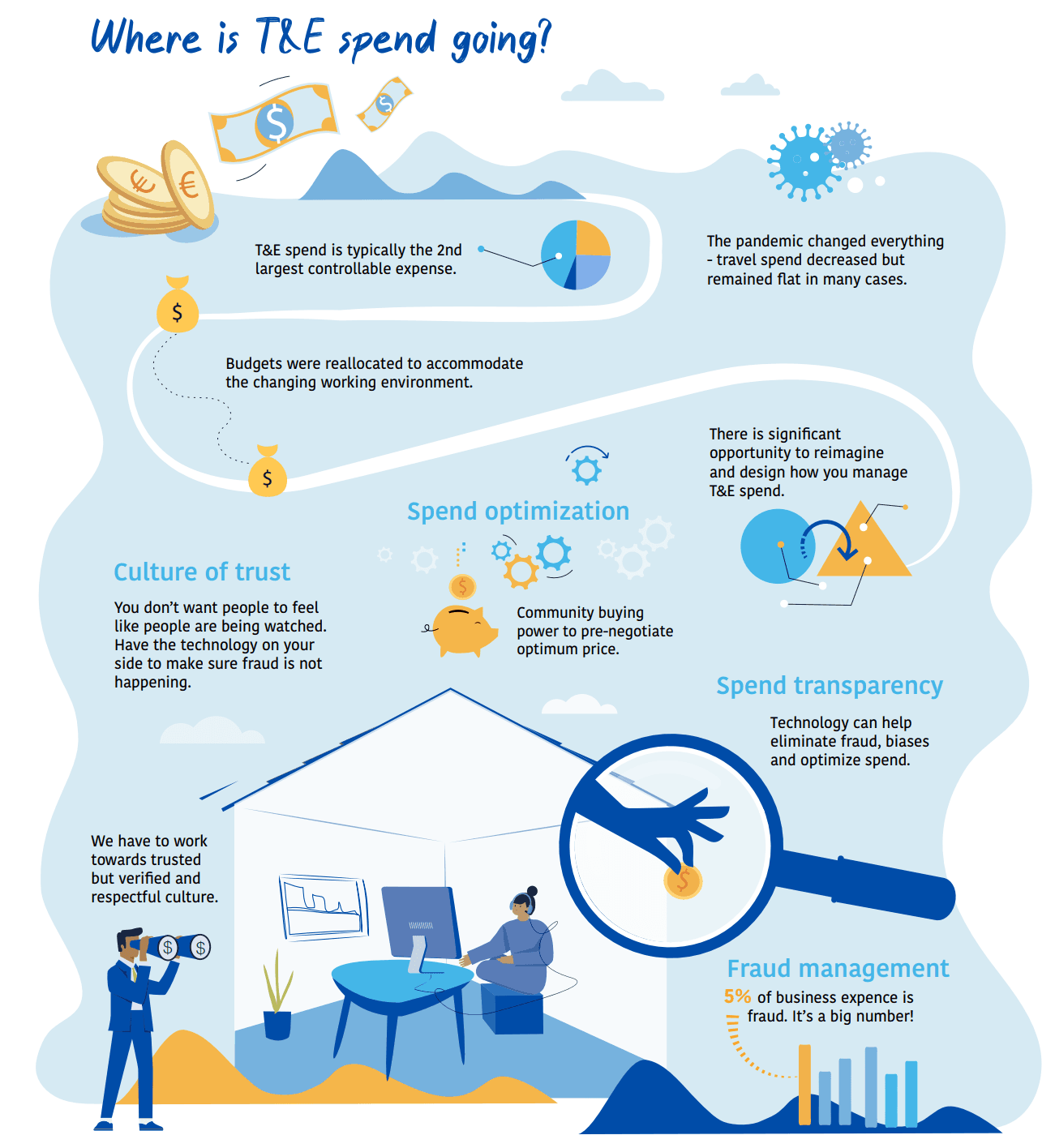

Where is T&E spend going?

Opportunities to Reimagine and Redesign T&E Spend Management

Culture of trust

You don’t want people to feel like people are being watched. We must work towards a trusted but verified and respectful culture.

Spend optimization

Leverage community buying power to pre-negotiate optimum pricing.

Spend transparency

Technology can help eliminate fraud, biases, and optimize spend.

Fraud management

5% of business expense is fraud. It is important to have technology on your side to make sure fraud is not happening.

Strategically managing T&E

Four main considerations when reevaluating your T&E program:

How user-centric is your T&E program?

How much spend visibility do you have?

Can you control T&E spend?

Are you making the most of your T&E spend?

If you want to stay ahead of the curve, you need to shift from tactical T&E management to strategic.